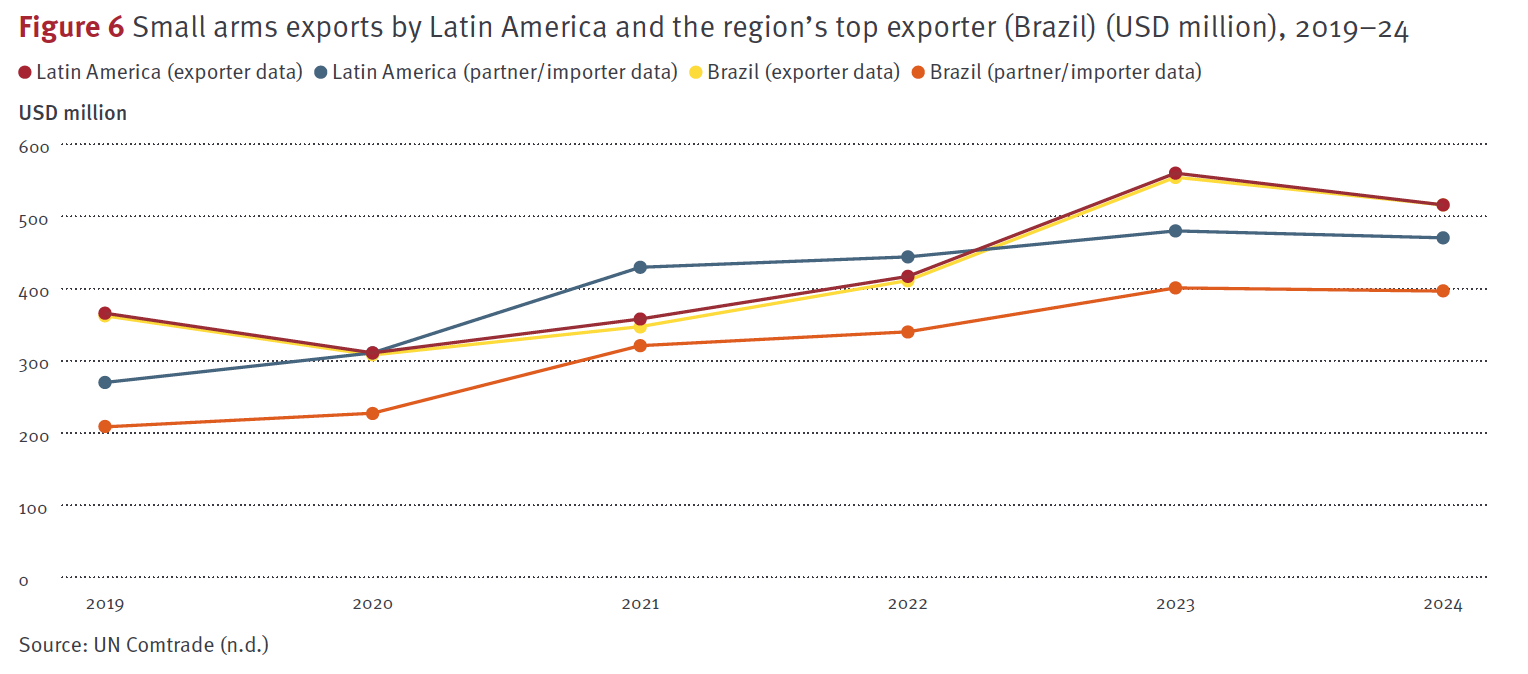

Latin America is a more discreet actor in the reported global trade in small arms. The region accounted for 6.3% of global small arms exports during 2019–24. While this proportion illustrates the region’s limited weight in global small arms exports, the annual value of reported exports from the region increased by 41% between 2019 and 2024 (see Figure 6).

This increase is due almost exclusively to a 42% increase in exports reported by Brazil, which is the world’s fifth-largest small arms exporter and accounted for almost 99% of all small arms exports reported by Latin American countries during the period under review. Brazil reported exports worth USD 2.5 billion to a total of 118 countries between 2019 and 2024, with the top five importers of Brazilian products comprising the United States (USD 1.4 billion), the United Arab Emirates (USD 145 million), Saudi Arabia (USD 107 million), the Philippines (USD 81 million),[1] and the Netherlands (USD 79 million).

While Brazil also accounts for the vast majority (79%) of Latin American exports reported by importing countries around the world, the partner data shows that other Latin American countries also export small arms, most notably Mexico (18%) and to a lesser extent Argentina (2%). These discrepancies, while not affecting overall longitudinal trends due to Brazil’s dominance of the regional trade, suggest partially incomplete reporting to UN Comtrade in the region.

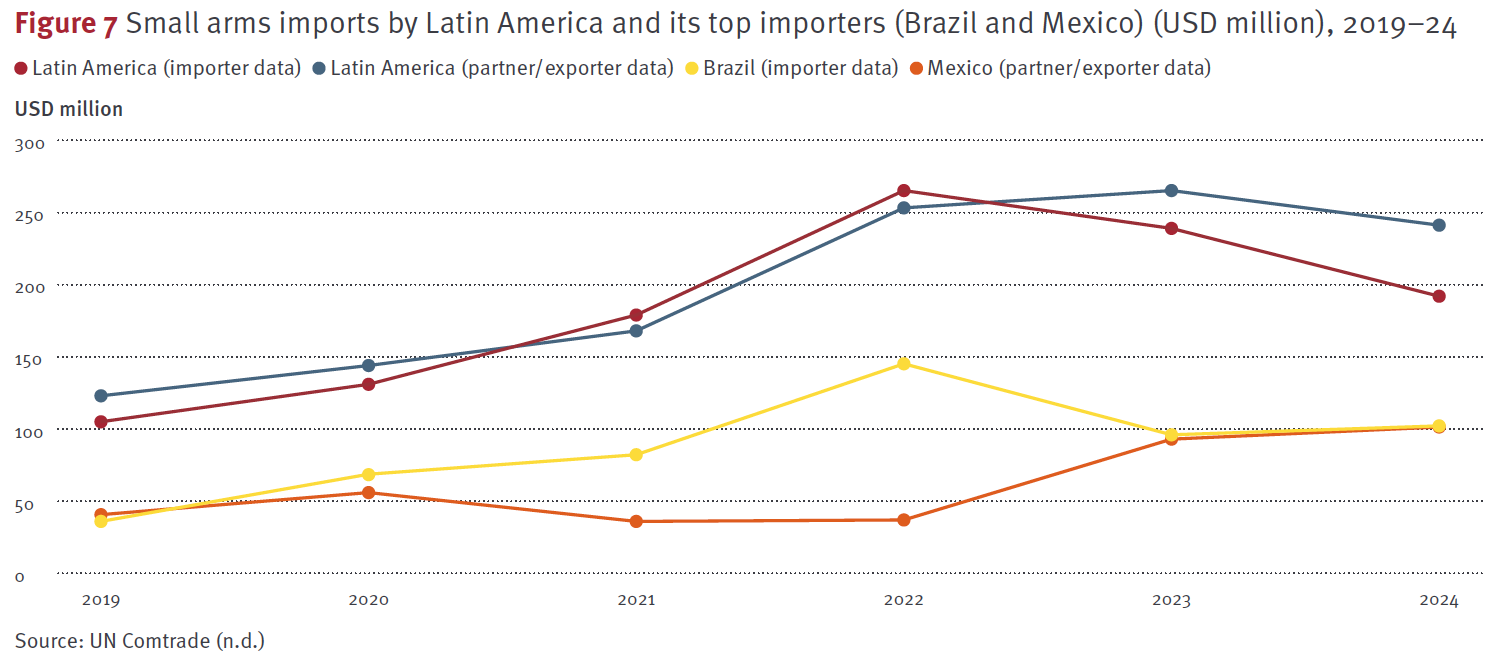

Latin America accounted for 2.8% of reported global small arms imports during the period 2019–24. While this figure suggests limited small arms imports by the region from a global perspective, these imports more than doubled (times 2.5) between 2019 and 2022, when they reached a total of almost USD 270 million (see Figure 7). The region’s imports subsequently decreased by 27% between 2022 and 2024, suggesting a certain volatility from year to year.

Indeed, annual imports by the region’s main importing countries, and notably Brazil, fluctuated markedly during this period, probably reflecting major acquisitions or contracts, or regulatory changes, during peak years. The value of Brazil’s reported imports increased by a ratio of 1 to 4 (times 4.1) from 2020 to 2022, likely influenced by new government policies that deregulated firearms possession by civilians and facilitated imports from foreign companies (for instance, through the removal of protections for the national industry).[2] Imports reported by Brazil subsequently decreased by 31% between 2022 and 2024.

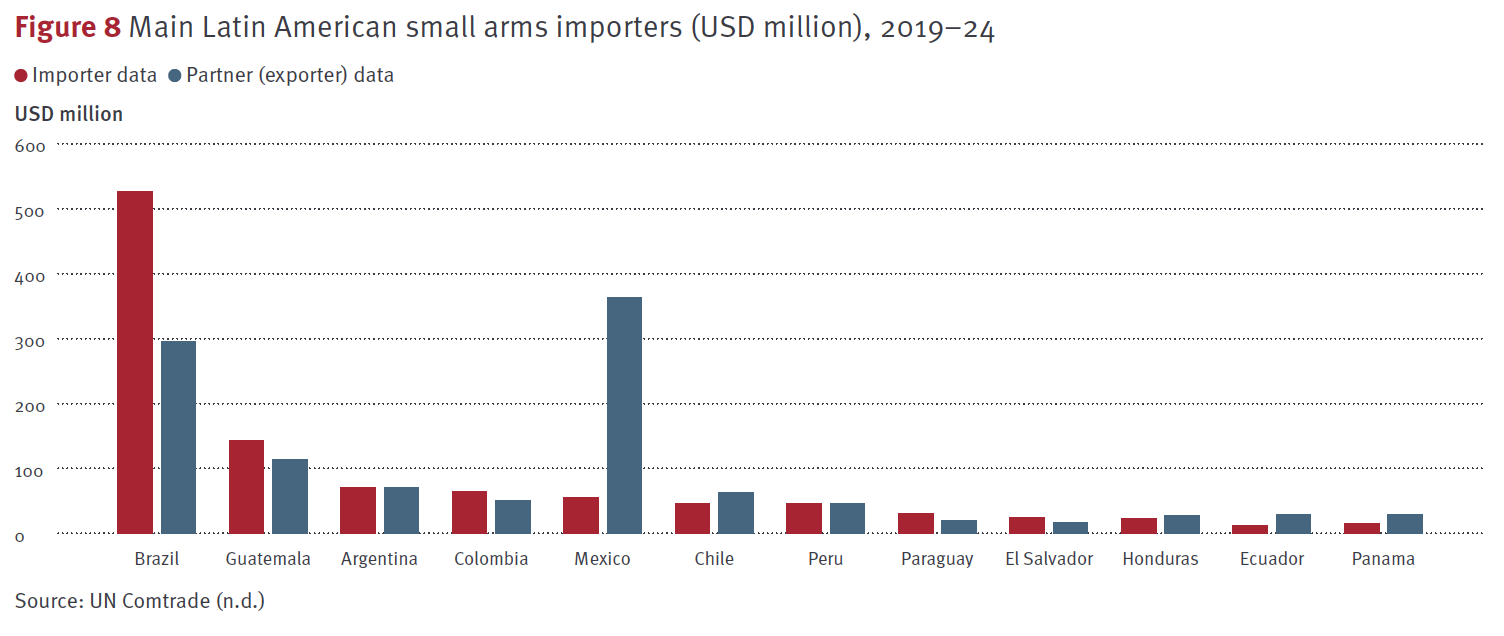

Based on import data, Brazil was the region’s largest importer of small arms between 2019 and 2024, accounting for 47% of all imports documented by Latin American states. Brazil’s imports during this period totalled USD 527 million, followed by Guatemala (USD 144 million), Argentina (USD 71 million), Colombia (USD 65 million), and Mexico (USD 55 million). For a country with a limited population (18 million), Guatemala’s imports stand out as regionally significant and may be a factor of the country’s relatively permissive civilian firearms legislation (C4ADS, 2024; Mack and Mieszkowska, 2025, p. 3; UNDESA Population Division, 2024).

Data submitted by the region’s trading partners (countries that reported exports to Latin American countries), however, suggests that Mexico was the region’s main importer of small arms (see Figures 7 and 8). Indeed, countries around the world reported USD 363 million worth of small arms exports to Mexico from 2019 to 2024, compared with USD 295 million to Brazil (see Figure 8). Official data released by Mexican authorities for the SNIS project for the years 2022 and 2023 (Coss, Mendez, and Cano, forthcoming) is relatively consistent with the UN Comtrade partner data, suggesting that Mexico has reported only a fraction of its actual small arms imports to UN Comtrade.

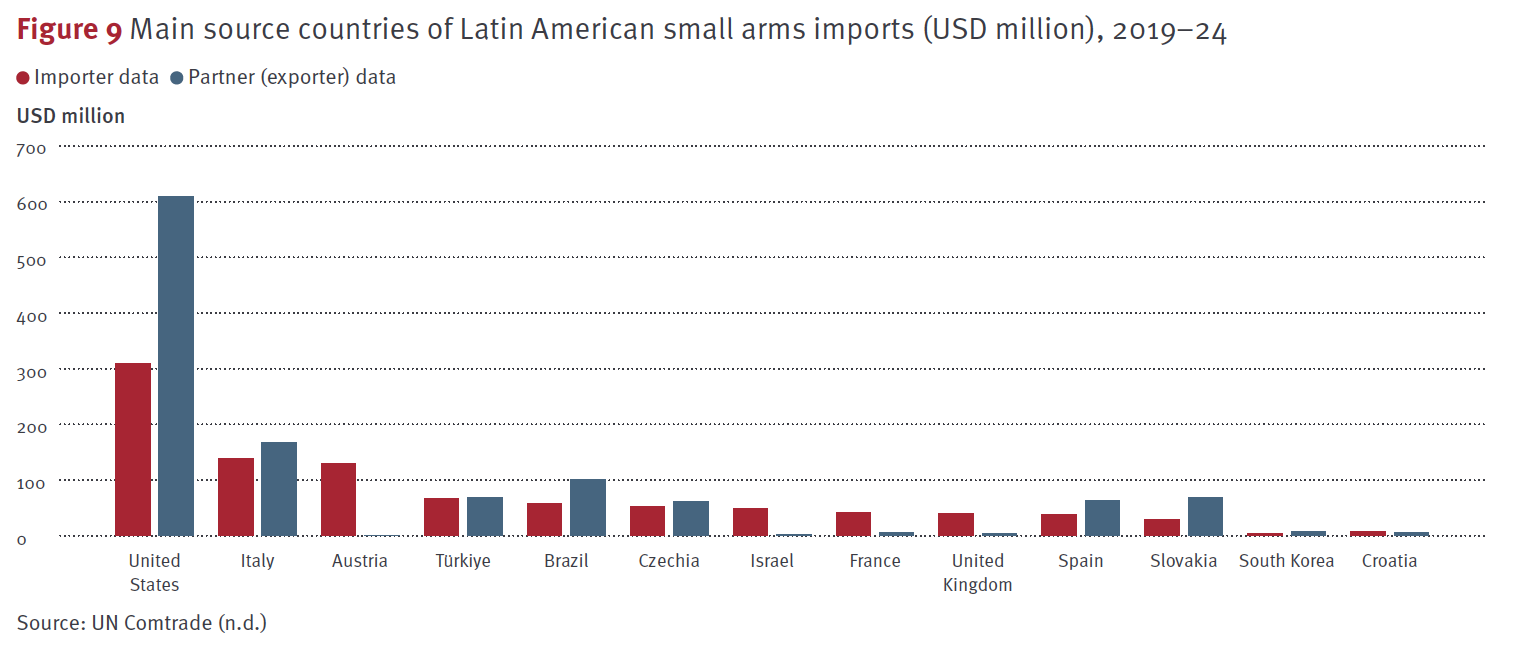

The United States, Italy, Austria, and Brazil are the only countries to have exported more than USD 100 million of small arms to Latin America between 2019 and 2024, based on either importer or partner data (see Figure 9). Brazil is therefore a significant exporter of small arms to the region itself, in addition to being the world’s fifth-largest arms exporter (see above).

[1] These imports were also reported in media reports. See, for instance, Padhila (2024).

[2] Langeani and Pollachi (2025); Oliveira (2019); Paraguassu (2019); Sant’Ana (2020).

| < PREVIOUS | NEXT PAGE > |