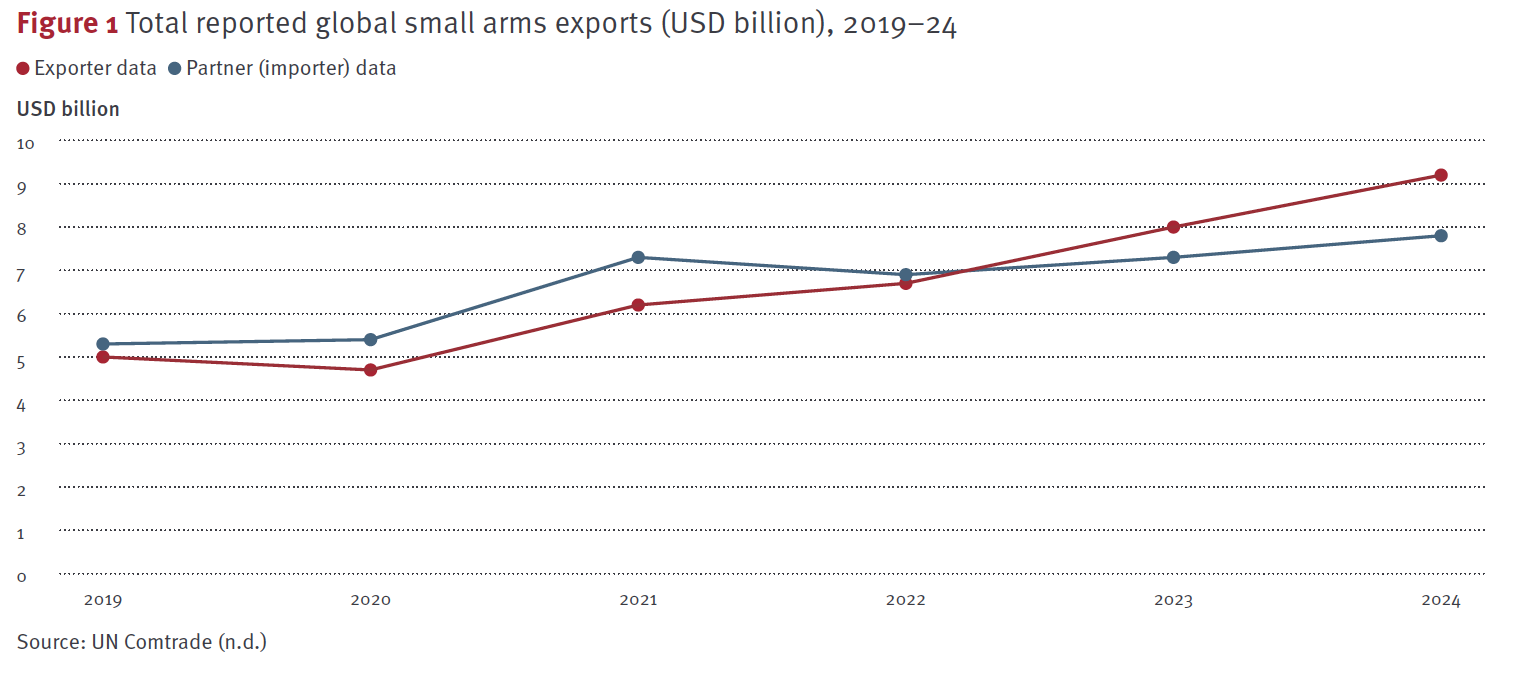

The global small arms trade measured in reported exports was worth USD 9.2 billion in 2024. This total reflects the continuation of the overall pattern of growth in this trade that has been observed over the past 20 years (Florquin, Hainard, and Jongleux, 2020). During the six years under review, the financial value of global small arms exports averaged about USD 6.6 billion per year, and rose sharply from USD

5 billion in 2019 to USD 9.2 billion in 2024—an 86% increase (see Figure 1). Even taking into consideration the 12.5% inflation rate over the same period (US BEA, 2025), these figures suggest a significant surge in the global value of the authorized trade between 2019 and 2024. Reported imports also rose by 46% during the study period to reach USD 7.8 billion in 2024, but with a more modest increase compared with global exports, particularly between 2021 and 2024 (see Figure 1). The cause for the discrepancy between global import and export data for recent years is unclear, although certain states taking a year or more to submit their data to UN Comtrade may be a factor (see ‘data sources and caveats’ above).

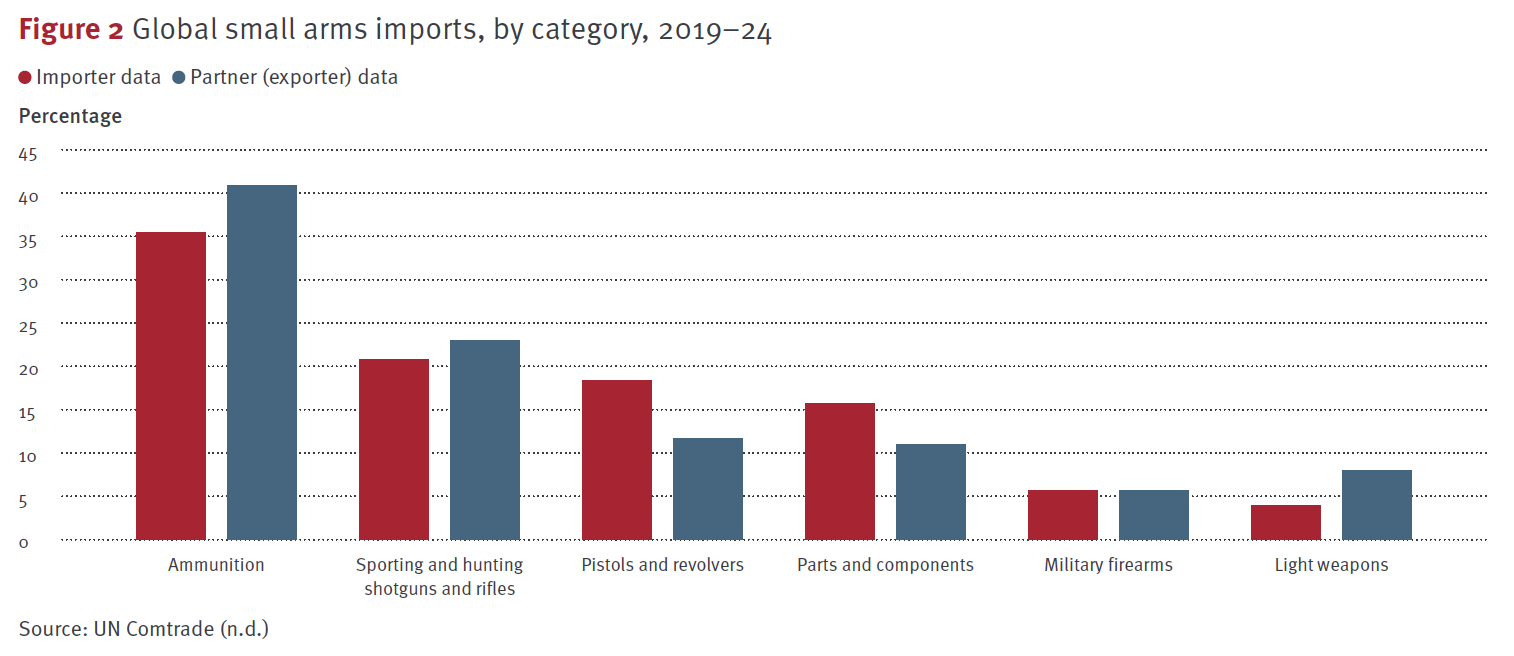

Ammunition was the most traded weapon category, accounting for 35% of the value of reported global imports for the period 2019–24, followed by sporting and hunting shotguns and rifles (21%), pistols and revolvers (18%), parts and components (16%), military firearms (6%), and light weapons (4%). Export data provides a similar picture, with the top category also being ammunition, accounting for 41% of global imports. Military firearms was the least imported category, however, at just under 6% (see Figure 2).

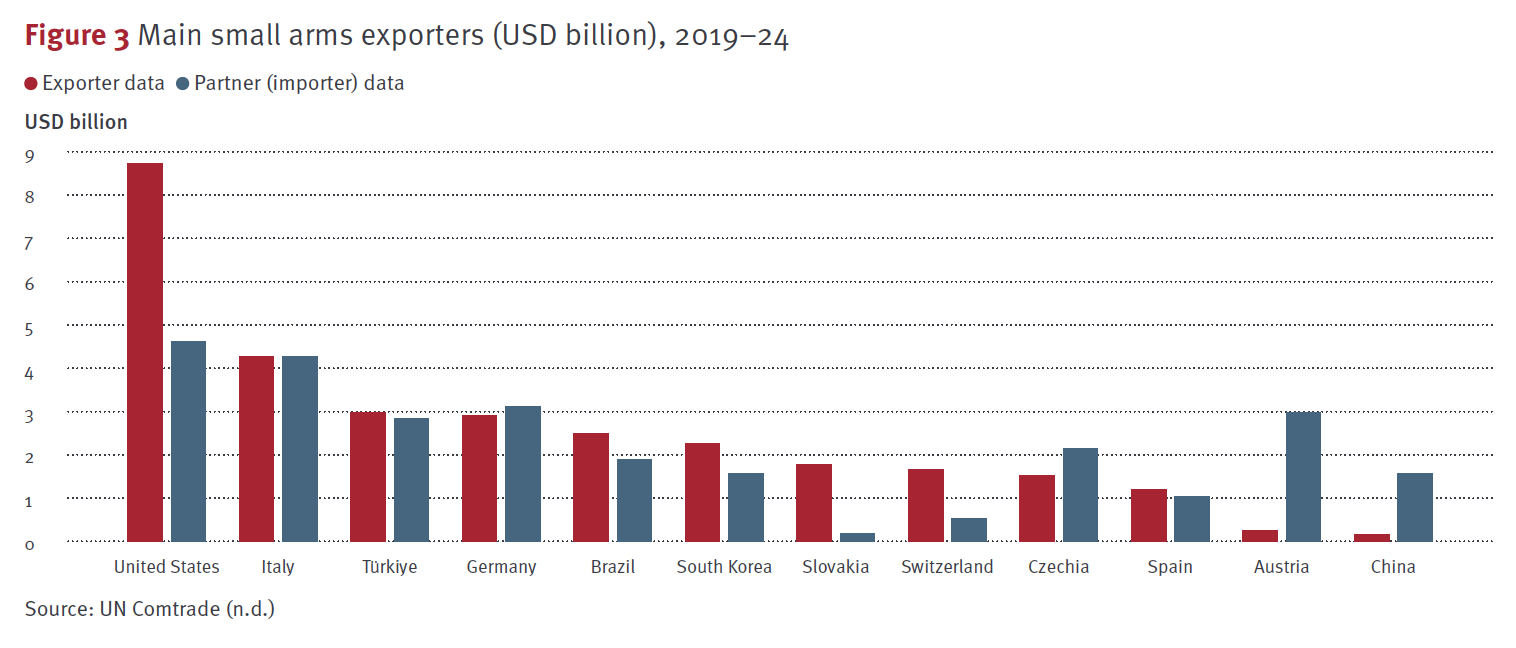

At the regional level, European countries accounted for more than half (51%) of reported global small arms exports between 2019 and 2024, followed by the Americas (31%) and Asia (17%). Africa and Oceania each accounted for less than 0.5% of the world’s exports.

From 2019 to 2024, the United States (USD 8.7 billion), Italy (USD 4.3 billion), Türkiye (USD 3 billion), Germany (USD 2.9 billion), and Brazil (USD 2.5 billion) were the top five small arms exporters (based on exporter data, see Figure 3). During this period, these five countries accounted for a combined 54% of all reported global exports of small arms. Exports significantly increased in several of the main exporting states, including Slovakia, whose reported exports measured in USD multiplied by 22 between 2019 and 2024, South Korea (by a factor of 5), Türkiye (by a factor of 2.3), Spain (by a factor of 2.2), and Brazil and Italy (by a factor of 1.4). Partner data (based on reports by importing countries) shows a slightly different picture, with China and Austria joining the world’s list of top ten exporters, and Slovakia and Switzerland being excluded (see Figure 3).

The United States (USD 18.5 billion), Canada (USD 1.9 billion), Poland (USD 1.7 billion), Germany (USD 1.4 billion), and Slovakia (USD 1.1 billion) were the five main importers of small arms globally over the period 2019–24. The United States is the only country that imported more than USD 1 billion worth of small arms annually, reaching as high as USD 4.1 billion in 2021. The United States accounted for 46% of all reported global small arms imports in the period under review.

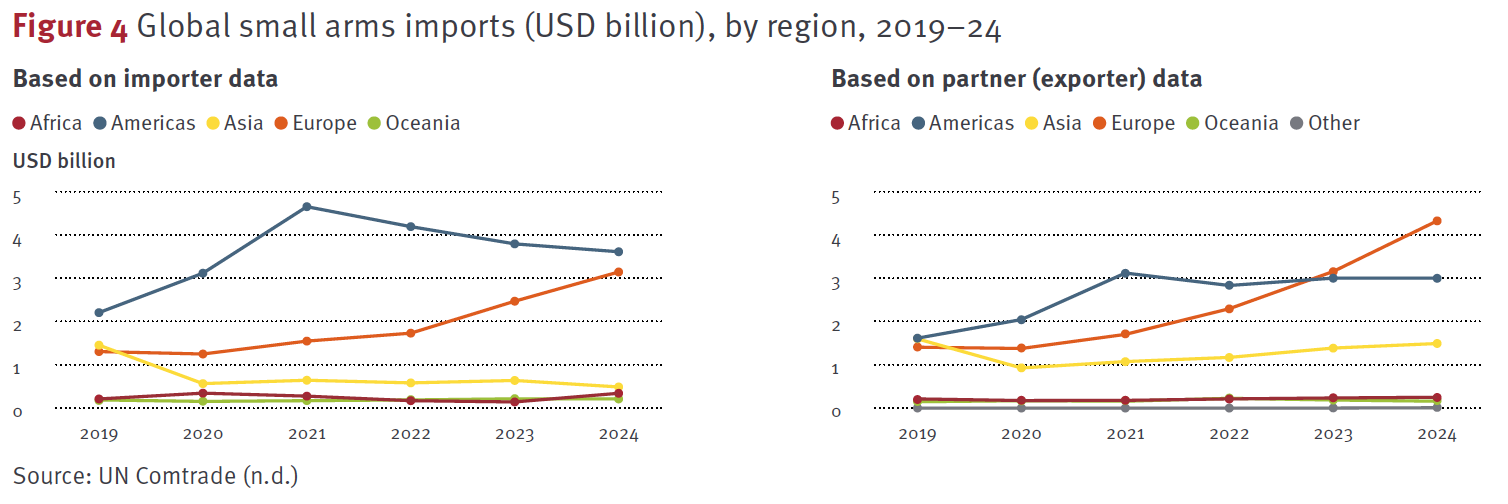

Regionally, however, Europe’s small arms imports are catching up with the Americas. European countries reported a significant increase in their imports—141% between 2019 and 2024—and accounted for 40% of all reported global imports in 2024. Based on partner (exporter) data, Europe even appears to have overtaken the Americas as the world’s leading regional importer of small arms in 2024 (see Figure 4).

This trend is consistent with that observed in European imports of all conventional arms. The latter increased by 155% between 2015–19 and 2020–24, due notably to Ukraine becoming the world’s largest importer of conventional weapons in the context of Russia’s full-scale invasion, which began in 2022 (George et al., 2025).

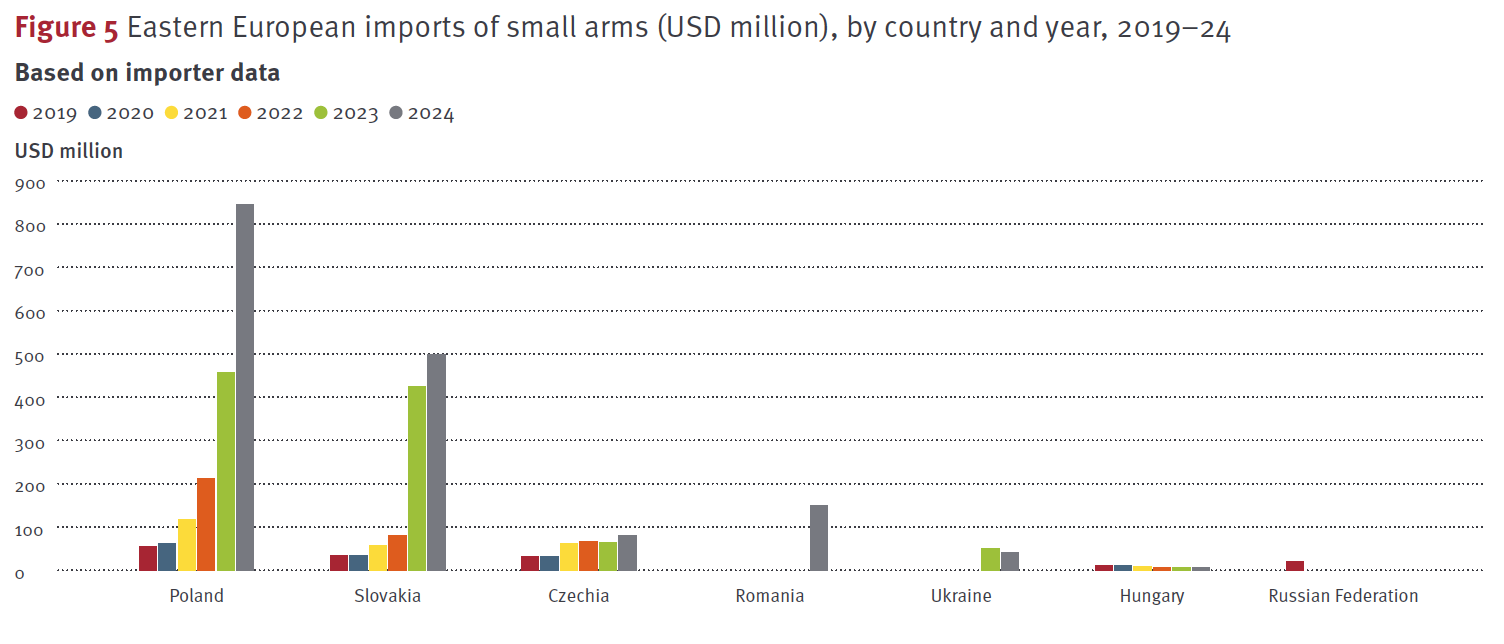

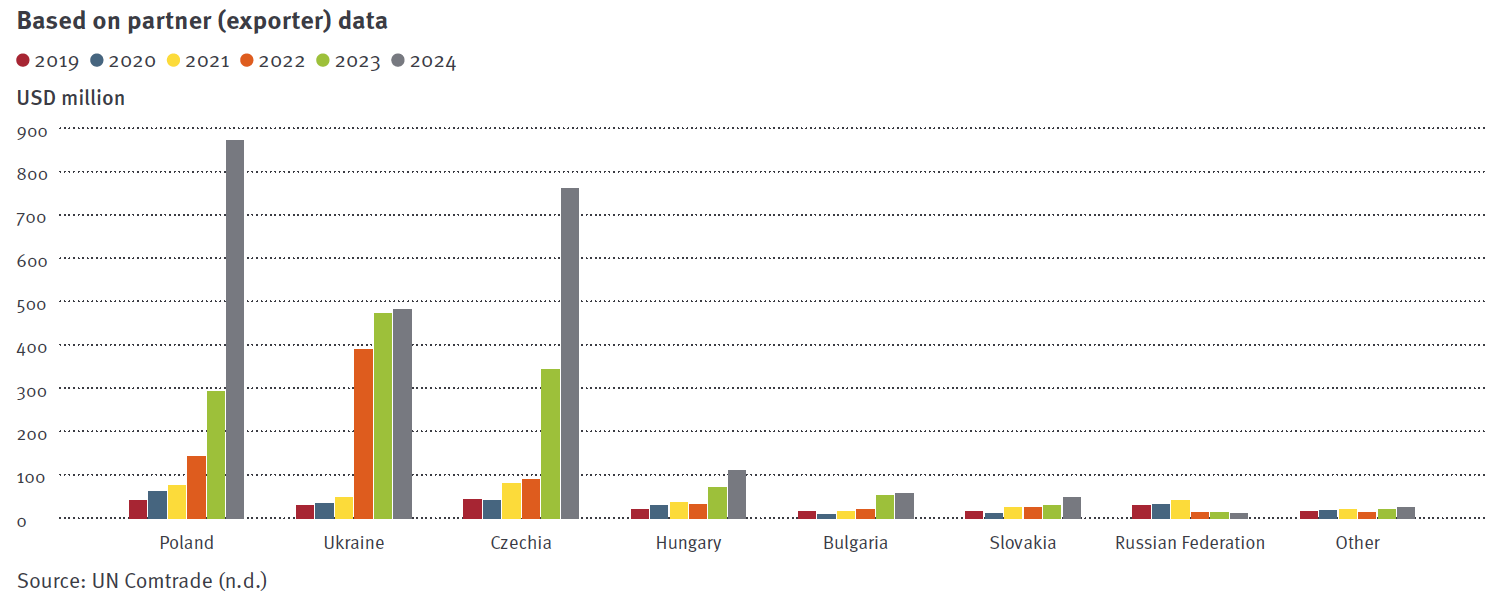

In fact, the substantial increase in European imports of small arms is primarily attributable to a significant rise in imports by Eastern European countries, the annual value of which multiplied by more than ten between 2019 and 2024. Based on data reported by the importers, Eastern European imports of small arms accounted for 52% of all European imports and 21% of global imports of small arms in 2024.

These proportions are even more significant when analysing the partner (exporter) data, with Eastern European imports accounting for 55% of all European imports and 26% of global imports in 2024. Given UN Comtrade’s focus on commercial transactions, these figures should be considered conservative as they may not account for all small arms donated to Ukraine and Russia by their allies, which could be significant (Forum on the Arms Trade, 2025; Korea Times, 2025).

Based on data submitted by Eastern European countries, the region imported small arms primarily from other European countries (61% of the total value), Asia (22%), and the Americas (17%). Data reported by the trading partners shows a different distribution: 39% of small arms exports to Eastern Europe were reported by countries in the Americas, followed by Europe (36%), and Asia (19%). Ammunition accounted for 55% of the reported Eastern European imports, followed by light weapons (20%), and parts and components (11%). This is broadly consistent with data reported by countries that exported to the region: according to the latter, ammunition accounted for 58% of these transfers, followed by light weapons (18%), and sporting and hunting shotguns and rifles (9%).

According to the Eastern European states’ import data, Poland, Slovakia, and Czechia were the subregion’s main importers, accounting for a combined 91% of Eastern Europe’s imports during the period under review. Partner data suggests a more diverse set of importers, however, with Poland, Ukraine, and Czechia accounting for 83% of the subregion’s imports as reported by exporters around the world. The other 17% comprise reported exports primarily to Hungary, Bulgaria, Slovakia, Russia, Romania, Moldova, and Belarus (see Figure 5).

In spite of these inconsistencies, taken together, the importer and partner data clearly show a significant rise in European small arms imports observed since 2019, due to a surge of imports by Eastern European importers in particular. This reflects broader regional arms supply and rearmament patterns triggered by the 2022 Russian invasion of Ukraine.

| < PREVIOUS | NEXT PAGE > |